unemployment tax credit irs

The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and qualify for the 10200 tax break. The Tax Department is issuing 475.

17 hours agoThe New York State Department of Taxation and Finance announced it has started mailing additional financial relief to eligible New Yorkers.

. If your non refundable tax credits covered you total tax liability that means you paid 0 taxes. However you may be eligible for additional tax credits but you may have to amend to properly claim them. If You Received Unemployment Benefits The IRS May Owe You Money.

The first phase includes the. SE Taxable Income 1277. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

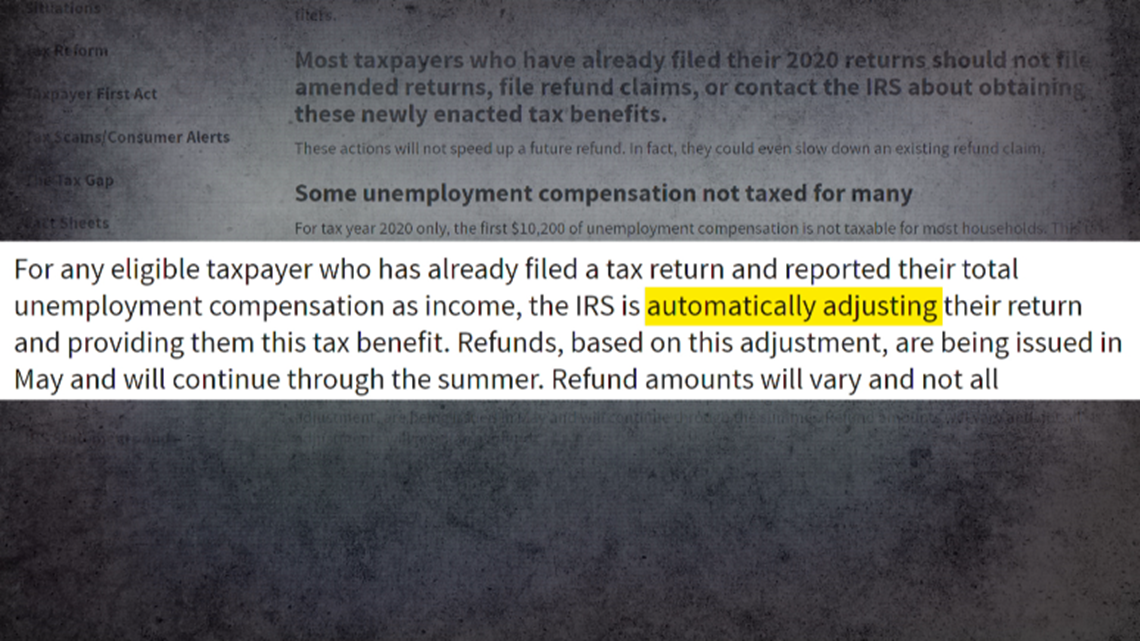

Return due date or return received date whichever is later processing date. The IRS for instance can adjust returns for taxpayers who claimed the Earned Income Tax Credit a refundable tax credit for low- to moderate-income working individuals and. Unemployment tax refunds then started landing in bank accounts in May and will run through the summer as the IRS processes the returns.

Most employers pay both a Federal and a state unemployment tax. Department of Labors Contacts for State UI. For a list of state unemployment tax agencies visit the US.

Feb 17 2022 The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. If you paid zero taxes there is nothing to refund by having less taxable income. Tax per Return 888.

To qualify for the full tax credit individuals must earn less than 75000 joint filers must make less than. Total SE Tax 195. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

Kare 11 Investigates Irs Facing Worst Tax Return Backlog In History Kare11 Com

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Unemployment Benefits Tax Issues Uchelp Org

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Dor Unemployment Compensation State Taxes

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of

How And Who Has To File An Amended Return To Get The 10 200 Irs Unemployment Tax Break As Usa

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Money And Finance News Live Updates January Unemployment Irs Letter 6475 Claim 1 400 Child Tax Credit Tax Returns As Usa

Irs Clarifies Payment Plans For Expanded Child Tax Credit Unemployment Deductions As Part Of Stimulus That S Rich Cleveland Com

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

When Will Irs Send Unemployment Tax Refunds 11alive Com

Tax Relief Notification Texas Workforce Commission

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com